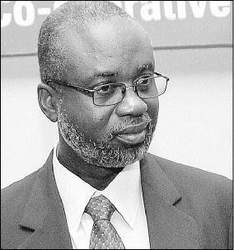

Glenworth Francis, general manager of the Jamaica Co-operative Credit Union League, says they are studying the Development Bank of Jamaica's fee proposal. - File

The Development Bank of Jamaica (DBJ) says it has offered credit unions a compromise - adding fees to loans - that should settle differences over the interest-rate spread at which they are allowed to lend.

The lending agencies, however, say the sector is still studying it but appear lukewarm to the idea.

DBJ, which distributes loan capital through approved financial institutions, or AFIs, stipulates that the interest rate to end users can be no more than three per cent higher than its rate to the AFIs.

The credit unions, however, say they need a spread of about eight per cent, otherwise it becomes unprofitable for them to distribute DBJ funds.

Fees to cover costs

Having considered their case, the DBJ has decided to maintain its 3.0 per cent policy on the spread, proposing instead that the agencies add fees to the loans to cover their costs, according to Yvonne Lewars, general manager of AFI Rela-tionships at the development bank.

But, general manager of the Jamaica Co-operative Credit Union League (JCCUL), Glenworth Francis, told Sunday Business the issue was not settled.

JCCUL, the umbrella body for credit unions, received the proposal in late March and would be reviewing it before taking a decision, Francis said.

The fee charges now being suggested by the DBJ might see SMEs paying more for the line of credit, but so far the credit unions are remaining mum.

The discussions over the spread arose late last year when credit unions began opting out of a $1- billion programme to funnel funds to small- and medium-size businesses, saying their cost to administer the funds were five per cent higher than the allowed spread.

Some $150 million was allocated for SMEs from the fund which became available April 1, 2008.

Possible losses

The money should have been retailed at 10 per cent per annum, to funnel affordable capital and open up credit flows in the SME segment.

But the JCCUL has maintained that its members would make losses on the programme at that loan rate.

According to marketing manager at Churches Co-operative Credit Union, Juvene Montague-An-derson, agencies like hers would not tap the $150 million until the nod comes from JCCUL.

Meanwhile, president of the Small Business Association of Jamaica, Edward Chin-Mook, said the SMEs urgently need credit and cash to breathe new life into their businesses.

The need, he indicates, may amount to billions in order to stimulate growth and revitalisation.

As defined by the DBJ, small enterprises are those with an asset base (excluding land and building) of US$10,000-US$100,000 and an annual turnover of US$125,000- US$1,000,000.

Employment does not usually exceed 50 persons.

Something meaningful

Lewars of the DBJ had hinted earlier this year that the prime minister would - in his Budget announcements in April - be bringing something meaningful to the table for the sector.

DBJ funds are also distributed through commercial banks and the PC Bank network.

In general, eligibility requirements include a demonstration of a net economic benefit to the country.

This includes the potential for employment creation, foreign-exchange earnings or savings, the facilitation and/or stimulation of foreign direct investments, expansion of export capacity, the diversification of an existing industry, the utilisation of local inputs, the demonstration of long-term financial viability and the ability to repay the DBJ funds.

Applicants must also demonstrate the development of management skills and technological know-how, indicate strong market demand for their products and/or services and demonstrate the ability to meet projected demand targets.

avia.ustanny@gleanerjm.com